How It Works?

Shufti aids clients in collecting vital investor information essential for onboarding and verification providing customised forms tailored to their unique business needs. Alternatively, clients can create their own forms for verification based on the required details. Whilst also giving clients the flexibility to integrate various KYC services to acquire diverse proofs as needed.

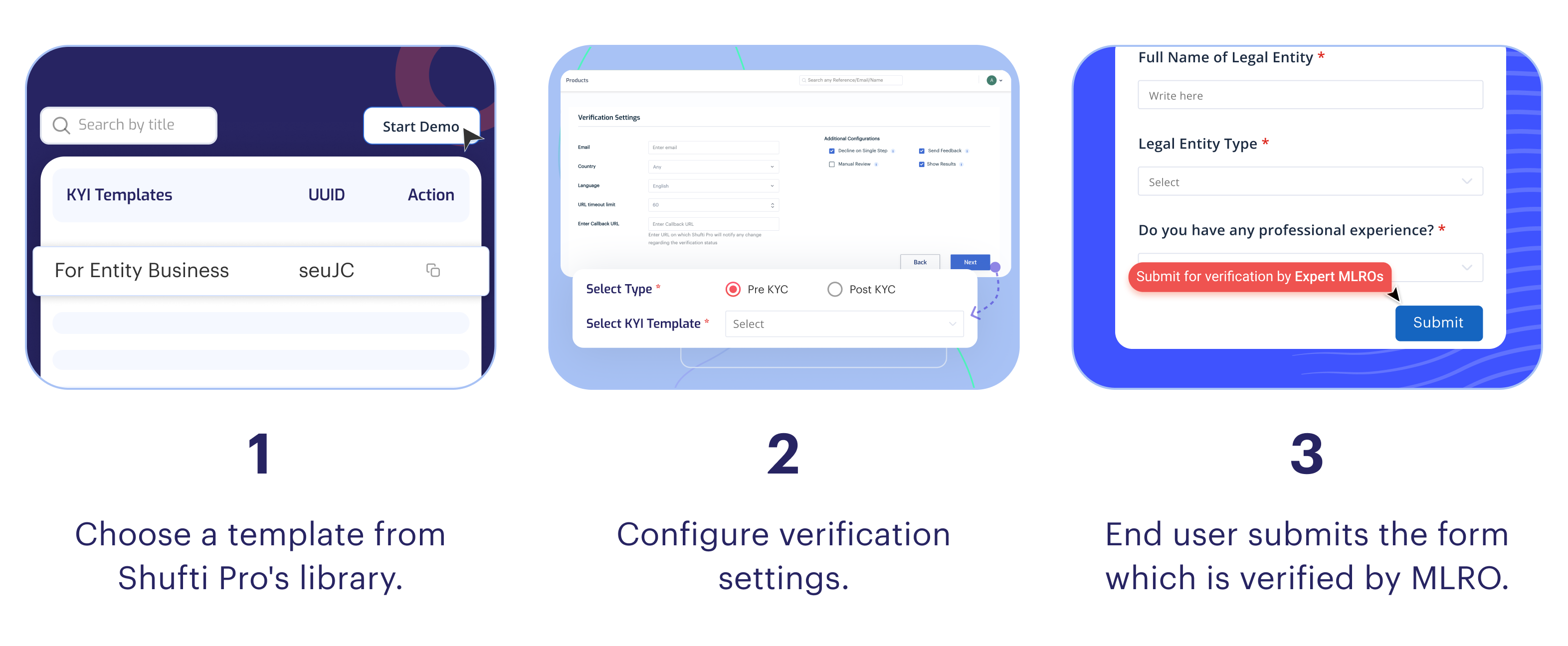

Investor Verification by Using Existing Form

Clients can streamline their Know Your Investor (KYI) verification process with Shufti by utilizing existing KYI forms, choosing up to five forms simultaneously for targeted information gathering whilst also benefiting from the flexibility to integrate KYI with other KYC services such as document and face verification, opting for either pre or post-KYC sequences.

- Navigate to the back office product demo section > Know Your Investor

- Click on the "Start Demo" button to initiate the use of an existing template for investor verification.

- Choose your preferences for pre/post-KYC services and generate a one-time product demo verification link.

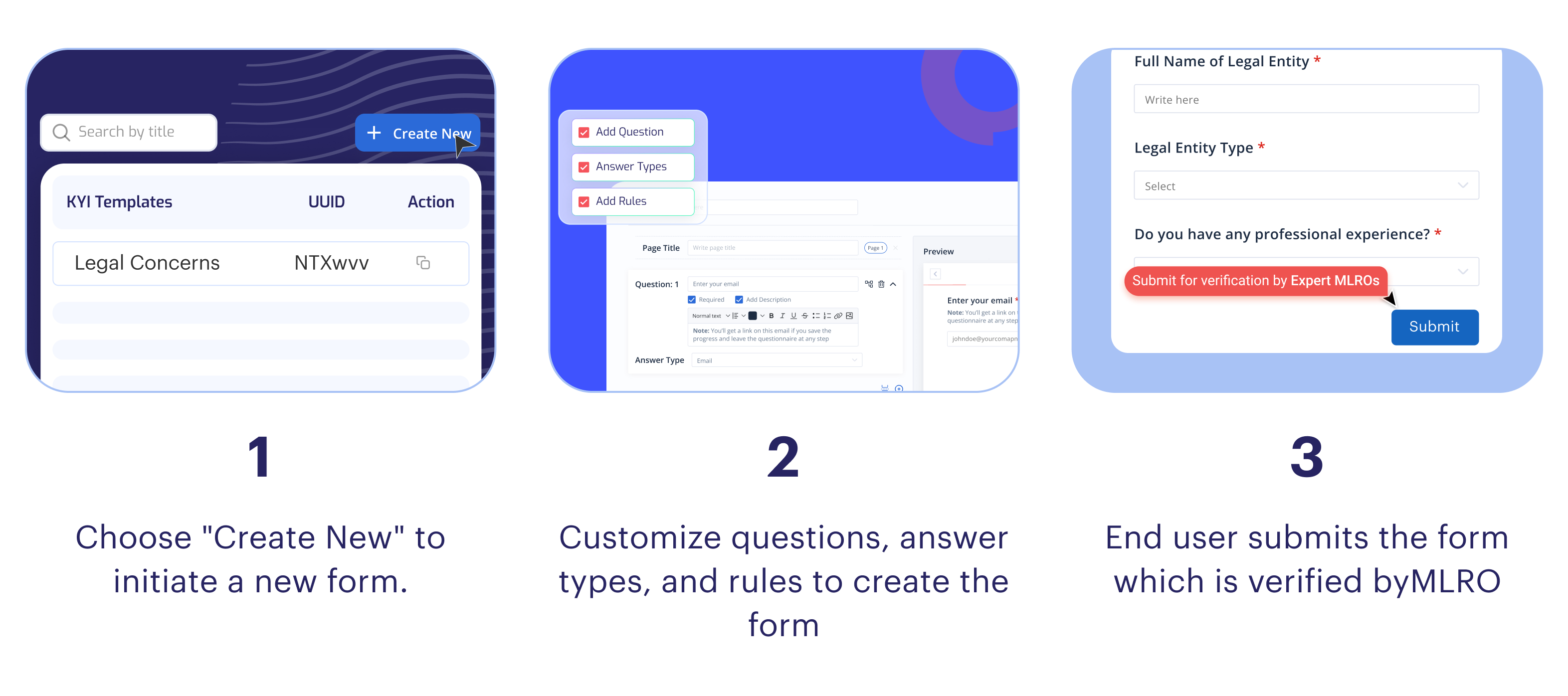

Investor Verification by Creating New form

- Navigate to the back office product demo section > Know Your Investor > Create New

- A new page will open, where you can set the title & description of the form.

- Going forward, you have the flexibility to create multiple questions within a single form tailored to your specific needs.

- Clients can implement page and question rules to direct users to specific questions and KYC flows according to their preferences.

- Finally the form can be saved and used for collecting investor’s data.

Investor Verification Form can only be created through Shufti's BackOffice.

Add Question

You can add as many questions as you need, depending on your business requirement.

By default the question limit in each due diligence form is set to 20. This can be updated by contacting the Shufti’s support team at [email protected].

To add questions follow these steps:

- Default Question: Upon form creation, a default question appears. Client can modify it, but keeping it is advised for saving progress if the end user leaves the form without submitting it.

- Add new Questions: Click the plus sign next to the page title to add new questions.

- Question Title: Write a title for each new question you add.

- Required Setting: Choose if the question is 'required' or optional and add a description as needed.

- Answer Type: Select the preferred answer format (e.g., Text, Float, Paragraph).

- Save Form: Click 'Proceed' to save your custom due diligence form.

Answer Types

Answer types allow you to collect the specific data to be collected from the end user according to your business requirements:

| Field | Description |

|---|---|

| Text | Single-line input for brief text, like names. |

| Dropdown | Compact menu for choosing one from many options. |

| Radio Buttons | Select one option from multiple choices. |

| Field for email addresses, with format validation. | |

| Upload File | Allows file uploads, such as documents or images. |

| Integer | For whole number inputs only. |

| Float | Accepts numbers with decimals. |

| Linear Scale | Numeric scale for ratings or evaluations. |

| Date | Date selection, often with a calendar interface. |

| Paragraph | Multi-line text box for longer responses. |

| Countries List | Dropdown list of countries for geographic selection. |

Add Rules

You can control the flow of due diligence form by adding rules on each question or page. In the Due Diligence Form, two types of rules are employed to achieve the desired workflow:

- Question Rules: Implement logic-driven visibility for questions or options based on end user responses. This feature enables you to tailor the form dynamically, showing or hiding additional elements according to the answers provided by the end user.

- Page Rules: Set up custom navigation within the form based on end user inputs. Page Rules allow you to direct end users to specific questions or sections of the form, ensuring a personalized and relevant experience tailored to their responses.

MLRO Verification

After the form has completed and submitted by the end user, our MLRO verifies the gathered information, guaranteeing the precision and authenticity of the investor details. Shufti provides clients the flexibility to choose between using their own MLROs or relying on Shufti's experienced and trained MLROs for the verification process.

Checkout all supported documents for Investor Verification service here.